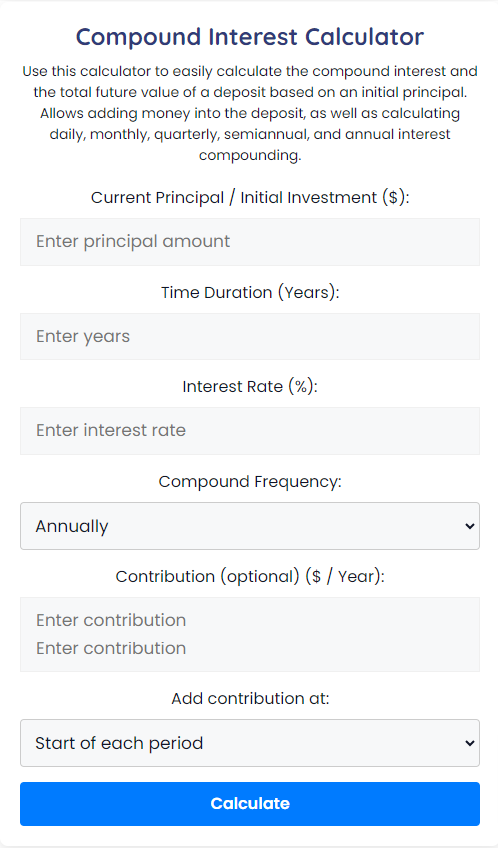

Compound Interest Calculator

Use this calculator to easily calculate the compound interest and the total future value of a deposit based on an initial principal. Allows adding money into the deposit, as well as calculating daily, monthly, quarterly, semiannual, and annual interest compounding.

Future investment value

$6,416.79Total interest earned

$1,416.79Initial balance

$5,000.00

Yearly rate → Compounded rate5% 5.12%All-time rate of return (RoR)

28.34%

Time needed to double investment

13 years, 11 monthsmonthlyyearly

| Year | Interest | Accrued Interest | Balance |

|---|---|---|---|

| 0 | – | – | $5,000.00 |

| 1 | $255.81 | $255.81 | $5,255.81 |

| 2 | $268.90 | $524.71 | $5,524.71 |

| 3 | $282.65 | $807.36 | $5,807.36 |

| 4 | $297.12 | $1,104.48 | $6,104.48 |

| 5 | $312.32 | $1,416.79 | $6,416.79 |

Use our free compound interest calculator to evaluate how your savings or investments might grow over time, with or without regular contributions. Our tool helps you see how compound interest can increase the value of your money as you plan for the future. Got questions? Just ask. Continue scrolling to learn how compound interest works—and how to make it work for you.👇

Read More: Tip Calculator

Making compound interest work for you

We’ve covered what compound interest is, but how do you make the most of it? Here are a few strategies to keep in mind:

- Start Early: Time plays an important role in compound interest. So, starting your investments early, even with smaller amounts, gives your money more time to grow and for the interest to compound.

- Regular Contributions: By consistently adding to your investment, you enhance the compounding effect (think about the analogy of a snowball). Each new contribution starts earning its own interest, adding to the overall growth.

- Higher Compounding Frequencies: When evaluating savings or investment options, pay attention to those that compound more frequently. The more often interest is compounded, the greater the potential for growth—although the difference may be minimal at lower interest rates.

Three simple strategies to consider when doing your long-term financial planning. As always, we recommend speaking to a qualified financial advisor for advice.

How is compound interest calculated?

Now that you understand how powerful compound interest can be, let’s break down how it’s calculated. Compound interest works by adding earned interest back to the principal. This generates additional interest in the periods that follow, which accelerates your investment growth.

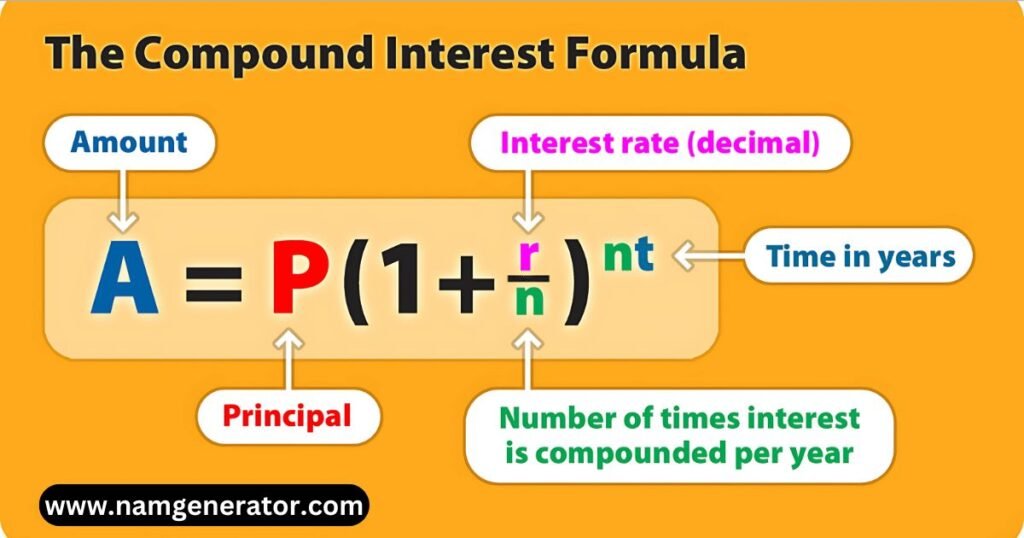

The formula used for calculating compound interest is:

A = P(1+r/n)^nt

Where:

- A = the future value of the investment

- P = the principal balance

- r = the annual interest rate (decimal)

- n = number of times interest is compounded per year

- t = the time in years

- ^ = … to the power of …

For example, if you want to calculate monthly compound interest, simply divide the annual interest rate by 12 (the number of months in a year), add 1, and raise the result to the power of 12 * t (years).

If you’d prefer not to do the math manually, you can use the compound interest calculator at the top of our page. Simply enter your principal amount, interest rate, compounding frequency and the time period. You can also include regular deposits or withdrawals to see how they impact the future value.

What will $10,000 be worth in 20 years?

We’ve discussed what compound interest is and how it is calculated. So, let’s now break down interest compounding by year, using a more realistic example scenario. We’ll say you have $10,000 in a savings account earning 5% interest per year, with annual compounding. We’ll assume you intend to leave the investment untouched for 20 years. Your investment projection looks like this…

| Year | Interest Calculation | Interest Earned | End Balance |

|---|---|---|---|

| Year 1 | $10,000 x 5% | $500 | $10,500 |

| Year 2 | $10,500 x 5% | $525 | $11,025 |

| Year 3 | $11,025 x 5% | $551.25 | $11,576.25 |

| Year 4 | $11,576.25 x 5% | $578.81 | $12,155.06 |

| Year 5 | $12,155.06 x 5% | $607.75 | $12,762.82 |

| Year 6 | $12,762.82 x 5% | $638.14 | $13,400.96 |

| Year 7 | $13,400.96 x 5% | $670.05 | $14,071 |

| Year 8 | $14,071 x 5% | $703.55 | $14,774.55 |

| Year 9 | $14,774.55 x 5% | $738.73 | $15,513.28 |

| Year 10 | $15,513.28 x 5% | $775.66 | $16,288.95 |

| Year 11 | $16,288.95 x 5% | $814.45 | $17,103.39 |

| Year 12 | $17,103.39 x 5% | $855.17 | $17,958.56 |

| Year 13 | $17,958.56 x 5% | $897.93 | $18,856.49 |

| Year 14 | $18,856.49 x 5% | $942.82 | $19,799.32 |

| Year 15 | $19,799.32 x 5% | $989.97 | $20,789.28 |

| Year 16 | $20,789.28 x 5% | $1,039.46 | $21,828.75 |

| Year 17 | $21,828.75 x 5% | $1,091.44 | $22,920.18 |

| Year 18 | $22,920.18 x 5% | $1,146.01 | $24,066.19 |

| Year 19 | $24,066.19 x 5% | $1,203.31 | $25,269.50 |

| Year 20 | $25,269.50 x 5% | $1,263.48 | $26,532.98 |

$10,000 invested at a fixed 5% yearly interest rate, compounded yearly, will grow to $26,532.98 after 20 years. This means total interest of $16,532.98 and a return on investment of 165%.

It’s important to remember that these example calculations assume a fixed percentage yearly interest rate. Real-life returns are rarely as predictable as these examples. If you are investing your money, rather than saving it in fixed rate accounts, the reality is that returns on investments will vary year on year due to fluctuations in interest rates, market conditions, inflation, and other economic factors.

It is for this reason that financial experts commonly suggest the risk management strategy of diversification.

Compounding with additional deposits

As we discussed in our section about growth strategies, combining interest compounding with regular deposits into your savings account, Roth IRA, 401(k) or other investment vehicle is a highly efficient saving strategy that can really boost the growth of your money in the longer term.

Looking back at our example from above, if we were to contribute an additional $100 per month into our investment, our balance after 20 years would hit the heights of $67,121, with interest of $33,121 on total deposits of $34,000.

As financial institutions point out, if people begin making regular investment contributions early on in their lives, they can see significant growth in their savings further down the road as their interest snowball gets larger and they gain benefit from Dollar-cost or Pound-cost averaging.

Note that you can include regular weekly, monthly, quarterly or yearly deposits in your calculations with our interest compounding calculator at the top of the page.

Where to invest for compound interest

The question about where to invest to earn the most compound interest has become a feature of our email inbox, with people thinking about mutual funds, ETFs, MMFs and high-yield savings accounts and wanting to know what’s best.

We at The Calculator Site work to develop quality tools to assist you with your financial calculations. We can’t, however, advise you about where to invest your money to achieve the best returns for you. Instead, we advise you to speak to a qualified financial advisor for advice based upon your own circumstances.

There are also some excellent articles from renowned financial websites that list ways to invest for compound interest. Here are two of the best articles, to help with your research:

- 13 Best Compound Interest Investments. WealthUp (author: Riley Adams).

- Accounts That Earn Compounding Interest. Motley Fool (author: Adam Levy).

How to Use the Compound Interest Calculator: Example

Say you have an investment account that increased from $30,000 to $33,000 over 30 months. If your local bank offers a savings account with daily compounding (365 times per year), what annual interest rate do you need to get to match the rate of return in your investment account?

In the calculator above select “Calculate Rate (R)”. The calculator will use the equations: r = n((A/P)1/nt – 1) and R = r*100.

Enter:

- Total P+I (A): $33,000

- Principal (P): $30,000

- Compound (n): Daily (365)

- Time (t in years): 2.5 years (30 months equals 2.5 years)

Showing the work with the formula r = n((A/P)1/nt – 1):r=365((33,00030,000)1365×2.5−1)r=365(1.11912.5−1)r=365(1.10.00109589−1)r=365(1.00010445−1)r=365(0.00010445)r=0.03812605R=r×100=0.03812605×100=3.813%

Your Answer: R = 3.813% per year

So you’d need to put $30,000 into a savings account that pays a rate of 3.813% per year and compounds interest daily in order to get the same return as the investment account.

How to Derive A = Pert the Continuous Compound Interest Formula

A common definition of the constant e is that:e=limm→∞(1+1m)m

With continuous compounding, the number of times compounding occurs per period approaches infinity or n → ∞. Then using our original equation to solve for A as n → ∞ we want to solve:A=P(1+rn)ntA=P(limn→∞(1+rn)nt)

This equation looks a little like the equation for e. To make it look more similar so we can do a substitution we introduce a variable m such that m = n/r then we also have n = mr. Note that as n approaches infinity so does m.

Replacing n in our equation with mr and cancelling r in the numerator of r/n we get:A=P(limm→∞(1+1m)mrt)

Rearranging the exponents we can write:A=P(limm→∞(1+1m)m)rt

Substituting in e from our definition above:A=P(e)rt

And finally you have your continuous compounding formula.A=Pert

Excel: Calculate Compound Interest in Spreadsheets

Use the tables below to copy and paste compound interest formulas you need to make these calculations in a spreadsheet such as Microsoft Excel, Google Sheets and Apple Numbers.

To copy correctly, start your mouse outside the table upper left corner. Drag your mouse to the outside of the lower right corner. Be sure all text inside the table is selected. Using Control + C and Control + V ; Paste the copied information into cell A1 of your spreadsheet. Formulas will only work starting in A1. You can modify the formulas and formatting as you wish.

Calculate Accrued Amount (Future Value FV) using A = P(1 + r/n)^nt

In this example we start with a principal investment of 10,000 at a rate of 3% compounded quarterly (4 times a year) for 5 years. If you paste this correctly you should see the answer Accrued Amount (FV) = 11,611.84 in cell B1. Change the values in B2, B3, B4 and B5 to your specific problem.

Copy and paste this table into spreadsheets as explained in the above section.

| Accrued Amount (FV) $ | = ROUND(B3 * POWER(( 1 + ((B2/100)/B4)),(B4*B5)),2) |

| Rate % | 3 |

| Principal $ | 10000 |

| Compounding per year | 4 |

| Years | 5 |

Calculate Rate using Rate Percent = n[ ( (A/P)^(1/nt) ) – 1] * 100

In this example we start with a principal of 10,000 with interest of 500 giving us an accrued amount of 10,500 over 2 years compounded monthly (12 times per year). If you paste this correctly you should see the answer for Rate % = 2.44 in cell B1. Change the values in B2, B3, B4 and B5 to your specific problem.

Copy and paste this table into spreadsheets as explained in the above section.

| Rate % | = ROUND(B4*((POWER((B2/B3),(1/(B4*B5))))-1)*100,2) |

| Accrued Amount $ | 10500 |

| Principal $ | 10000 |

| Compounding per year | 12 |

| Years | 2 |

Compounding with additional contributions

As impressive an effect as compound interest has on savings goals, true progress also depends on making steady contributions. Let’s go back to the savings account example above and use the daily compound interest calculator to see the impact of regular contributions.

- We started with $10,000 and ended up with $6,486.65 in interest after 10 years in an account with a 5% annual yield.

- Now say you deposit an additional $100 at the end of each month into your savings account. (Enter “$100” in the “Contribution amount” field, then select “Monthly” for the “Contribution frequency” option.) You would end up with $32,023.26 after 10 years, compounded daily (assuming 365 days a year).

- The interest would be $10,023.26 on total deposits of $22,000. (Review NerdWallet’s round-up of high-yield savings accounts and CDs to see how much interest you could be earning with different options.)

Compounding investment returns

When you invest in the stock market, you don’t earn a set interest rate, but rather a return based on the change in the value of your investment. The value of your investment could go up or down. When the value of your investment goes up, you earn a return.

When the returns you earn are invested in the market, those returns compound over time in the same way that interest compounds.

If you invested $10,000 in a mutual fund and the fund earned a 6% return for the year, it means you gained $600, and your investment would be worth $10,600. If you got a 6% return compounded annually for two years, your investment would be worth $11,236.

In reality, investment returns will vary year to year and even day to day. In the short term, riskier investments such as stocks or stock mutual funds may lose value. But over a long time horizon, history shows that a diversified growth portfolio can return an average of 6% annually. Investment returns are typically shown at an annual rate of return.

The money can add up: If you kept the funds in a retirement account for over 30 years and earned that 6% average return, for example, your $10,000 would grow to more than $57,000.

Compounding can help fulfill long-term savings and investment goals, especially if you have time to let it work its magic over years or decades. You can earn far more than what you started with.

Conclusion:

A Compound Interest Calculator is an invaluable tool for anyone looking to understand the power of compounding and make informed financial decisions. By providing accurate and personalized calculations, this tool helps individuals plan for their financial future, whether it’s saving for retirement, investing in education, or growing wealth over time.

The ability to input various parameters such as initial investment, interest rate, and compounding frequency allows users to see the long-term impact of their financial choices. This can be particularly motivating, as it demonstrates how even small, consistent contributions can grow significantly over time.

Moreover, the Compound Interest Calculator is not just for personal finance; it can also be a useful educational tool. Teachers and financial advisors can use it to illustrate the principles of compound interest, helping students and clients grasp the importance of saving and investing early.

In conclusion, the Compound Interest Calculator is a powerful resource that empowers users to take control of their financial future. By understanding and leveraging the power of compound interest, individuals can make smarter financial decisions, achieve their goals more effectively, and build a more secure future. Whether you’re a seasoned investor or just starting your financial journey, this tool can be a valuable ally in your pursuit of financial success.

Read More: Compound Interest Calculator

FAQs:

Q: What is a Compound Interest Calculator?

A: A Compound Interest Calculator is an online tool designed to help you calculate the future value of an investment that grows at a compounded interest rate.

Q: Why should I use a Compound Interest Calculator?

A: Using a Compound Interest Calculator can help you understand the power of compounding, plan for future financial goals, and make informed investment decisions.

Q: Where can I find a Compound Interest Calculator?

A: Compound Interest Calculators are widely available online. You can find them by searching for “Compound Interest Calculator” in your preferred search engine, or you might find them on financial, investment, or banking websites.

Q: What information do I need to use a Compound Interest Calculator?

A: To use a Compound Interest Calculator, you typically need to provide the initial investment amount, the annual interest rate, the compounding frequency, and the number of years you plan to invest.

Q: How does compound interest work?

A: Compound interest is calculated on the initial principal and also on the accumulated interest from previous periods. This means that interest is earned on interest, leading to exponential growth over time.

Q: What is the formula for compound interest?

A: The formula for compound interest is A = P(1 + r/n)^(nt), where A is the amount of money accumulated after n years, including interest. P is the principal amount, r is the annual interest rate (decimal), n is the number of times that interest is compounded per year, and t is the time the money is invested for in years.

Q: What is the difference between simple and compound interest?

A: Simple interest is calculated only on the principal amount, while compound interest is calculated on the principal and the accumulated interest, leading to faster growth over time.

Q: How often is interest typically compounded?

A: Interest can be compounded at various frequencies, such as annually, semi-annually, quarterly, monthly, or even daily. The compounding frequency can significantly impact the future value of an investment.

Q: Can I use a Compound Interest Calculator for different compounding frequencies?

A: Yes, most Compound Interest Calculators allow you to input different compounding frequencies, such as annually, semi-annually, quarterly, monthly, or daily.

Q: How accurate are the results from a Compound Interest Calculator?

A: The results from a Compound Interest Calculator are typically very accurate, as they are based on standard mathematical formulas. However, always double-check your inputs to ensure accuracy.

Q: Can I use a Compound Interest Calculator on my mobile device?

A: Yes, most online Compound Interest Calculators are mobile-friendly and can be used on smartphones and tablets. Some calculators may also be available as mobile apps.

Q: Do I need to create an account to use a Compound Interest Calculator?

A: Most Compound Interest Calculators do not require you to create an account. They are typically free to use and do not require any personal information.

Q: Can I use a Compound Interest Calculator for multiple investments?

A: Yes, you can use a Compound Interest Calculator for multiple investments. Simply input the details for each investment separately to calculate their future values.

Q: What if the Compound Interest Calculator asks for information I don’t understand?

A: If you encounter any confusion while using a Compound Interest Calculator, look for help icons or tooltips within the calculator. You can also consult online guides or tutorials for further explanation.

Q: Can I save or print the results from a Compound Interest Calculator?

A: Some Compound Interest Calculators may allow you to save or print the results. Look for print or save buttons on the results page. Alternatively, you can take a screenshot or manually note down the results.

Q: What if the Compound Interest Calculator doesn’t seem to be working properly?

A: If the Compound Interest Calculator doesn’t seem to be working properly, try refreshing the page, clearing your browser cache, or using a different browser. If the issue persists, consider using an alternative calculator.

Q: Can I use a Compound Interest Calculator for both savings and loans?

A: Yes, a Compound Interest Calculator can be used for both savings and loans. For loans, you can input the loan amount as the initial investment and the interest rate as the loan rate to calculate the future value of the loan.

Q: How does the compounding frequency affect the future value of an investment?

A: The compounding frequency affects the future value of an investment because the more frequently interest is compounded, the faster the investment grows. Higher compounding frequencies lead to greater accumulated interest over time.

Q: Can I use a Compound Interest Calculator to compare different investment options?

A: Yes, you can use a Compound Interest Calculator to compare different investment options by inputting the details for each option and comparing the future values.

Q: What if I need to calculate the future value of an investment with additional contributions?

A: Some Compound Interest Calculators allow you to input additional contributions, such as regular deposits, to calculate the future value of an investment with ongoing contributions.

Q: Can I use a Compound Interest Calculator to plan for retirement?

A: Yes, a Compound Interest Calculator can be a valuable tool for retirement planning. By inputting your retirement savings goals, interest rates, and compounding frequencies, you can estimate how much you need to save to reach your retirement goals.